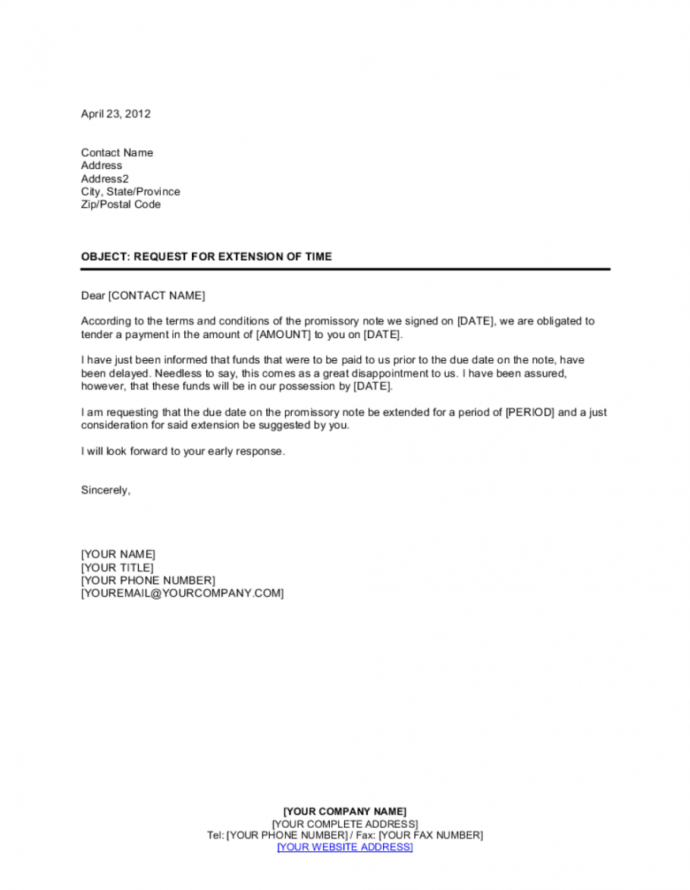

One simple way to formalize the loan is with a promissory note. Montana law defines the loaning of money as ‘a contract by which one delivers a sum of money to another and the latter agrees to return at a future time a sum equivalent to that which he borrowed.’ When repayment of the money is expected, a formalized arrangement provides protection for the lender, for the borrower and for other family members. Reduce the family member’s bequest by the loan amount. If you are financially secure and willing to lend money to a family member, you have four basic options:Ĥ. Some people do not want to divulge the particulars of their own financial situation, good or bad, to another family member.

Explanations really are not necessary unless you feel comfortable revealing that information to the family member requesting the loan. Some people may feel the need to explain why they cannot make the loan.

This MontGuide describes alternatives and possible legal and emotional consequences to consider when a loan is made between family members.įirst of all, if you do not have the money to lend or you do not feel comfortable about making the loan, say “no” politely but firmly. Educational expenses, business start-up costs, medical expenses, purchase of a first car or house or insufficient income during periods of unemployment or retirement are situations that can trigger a loan from one family member to another. Economic conditions and lack of access to money from traditional lenders often result in people turning to friends or relatives for loans.

0 kommentar(er)

0 kommentar(er)